Today, the banking industry is undergoing a transformative shift, adopting progressive technologies to streamline operations and enhance customer experiences.

At the forefront of this revolution is Vinove, a pioneering company dedicated to reshaping the banking landscape through innovative digital solutions.

Vinove’s cutting-edge offerings are revolutionizing how banks interact with their customers, offering seamless, personalized experiences that transcend traditional boundaries.

From mobile banking apps that put convenience at users’ fingertips to robust cybersecurity measures that safeguard sensitive data, Vinove’s solutions are designed to meet the evolving needs of modern banking.

With a deep understanding of the industry’s challenges and a commitment to excellence, Vinove empowers financial institutions to unlock new realms of efficiency, security, and customer satisfaction.

In this blog post, we’ll understand and discuss how Vinove is paving the way for a future where convenience and security go hand in hand.

Understanding the Banking Topographies

To begin our exploration of Vinove’s impact on banking, it’s crucial to understand the current state of the banking industry.

Traditional banks face challenges such as lengthy processes and limited accessibility.

However, technology is rapidly reshaping this landscape, offering solutions that make banking quicker and more convenient. Here’s a simplified overview:

Traditional Challenges

- Lengthy paperwork for transactions

- Limited availability with fixed banking hours

- Inconvenient branch visits

Digital Transformation

- Introduction of online banking services

- Availability of mobile banking apps for anytime access

- Integration of AI and chatbots for customer assistance

Role of Technology

- Improving banking efficiency

- Enhancing customer experience

- Enabling secure and convenient transactions

Understanding these dynamics lays the groundwork for appreciating how Vinove’s digital solutions are reshaping the banking landscape.

Vinove’s Approach to Digital Solutions

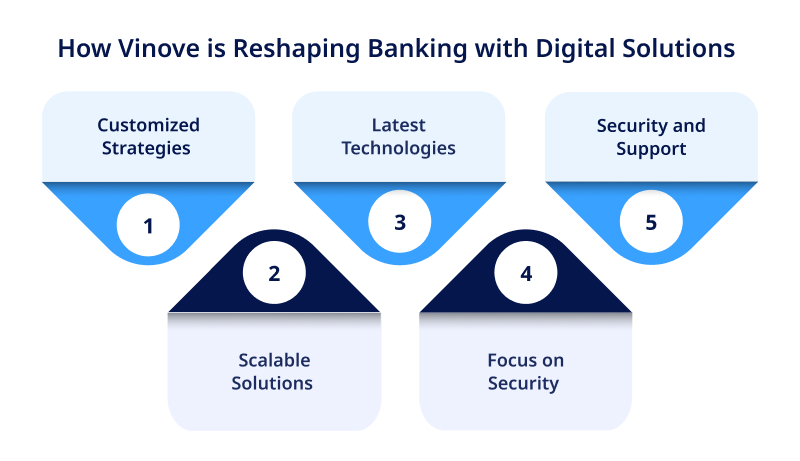

Vinove’s approach to digital solutions in banking is comprehensive and customized to keep up with the constantly changing needs of the industry.

With a focus on digital banking solutions and banking digital transformation, Vinove makes sure that financial institutions stay ahead in the rapidly changing world.

Here’s how Vinove approaches digital solutions:

- Customized Strategies: Vinove understands that each bank is unique, so we tailor their strategies to fit specific needs and goals.

- Latest Technologies: We utilize the latest technologies to offer innovative solutions, ensuring banks are at the forefront of digital transformation services.

- User-Centric Designs: Vinove prioritizes user experience, designing easy interfaces that make banking services seamless and accessible for customers.

- Scalable Solutions: Understanding the importance of scalability, Vinove’s solutions are designed to grow with the bank, accommodating changes in size and scope.

- Complete Support: From implementation to ongoing support, Vinove offers comprehensive assistance, making sure a smooth transition to digital banking solutions.

- Focus on Security: With the hovering cybersecurity threats, Vinove prioritizes security, implementing robust measures to protect sensitive data and transactions.

Vinove’s approach combines technological expertise with a deep understanding of the banking industry, strengthening banks’ ability to thrive digitally.

Advantages for Banks and Customers

The advantages of digital banking solutions extend to both banks and customers, offering many benefits in the always-changing financial technology innovations.

Let’s understand how digital transformation strategies positively impact banks and customers alike:

For Banks

- Improved Efficiency: Digital banking solutions streamline processes, reducing manual tasks and operational costs.

- Enhanced Customer Experience: With user-friendly interfaces and 24/7 accessibility, banks can provide personalized services, fostering stronger customer relationships.

- Competitive Edge: Adopting digital transformation puts banks one step ahead of the curve, attracting tech-savvy customers and staying relevant in a rapidly evolving market.

- Data-Driven Insights: Digital platforms generate valuable data insights, enabling banks to make informed decisions and improve services.

For Customers

- Convenience: Digital banking allows customers to manage their finances anytime, anywhere, eliminating the need for branch visits.

- Improved Accessibility: With mobile apps and online banking, customers have easy access to a wide range of banking services at their fingertips.

- Personalization: AI-driven solutions offer personalized recommendations and insights tailored to individual financial needs and goals.

- Better Security: Advanced security measures protect customer data and transactions, instilling confidence in digital banking platforms.

So, digital banking solutions driven by financial technology innovations bring tangible benefits to both banks and customers, revolutionizing the way financial services are delivered and experienced.

Vinove’s Strategies to Overcome Challenges

Vinove employs strategic approaches to overcome challenges in digital banking solutions, ensuring seamless integration and optimal outcomes for clients. Here’s a closer look at Vinove’s strategies:

- Comprehensive Analysis: Vinove conducts thorough assessments to identify potential challenges and develop tailored solutions that align with clients’ specific needs.

- Collaborative Partnership: By fostering collaborative relationships with clients, Vinove ensures open communication and understanding, facilitating the smoother implementation of digital banking solutions.

- Continuous Innovation: Vinove stays at the forefront of technological advancements, continuously innovating its banking solutions to address emerging challenges and capitalize on opportunities presented by the rise of AI.

- Agile Implementation: Employing agile methodologies, Vinove ensures flexibility and adaptability throughout the implementation process, allowing for iterative improvements and adjustments as needed.

- Robust Security Measures: Recognizing the importance of data security, Vinove integrates robust security measures into its solutions, safeguarding sensitive information and mitigating potential risks associated with digital transformation.

Through these strategic initiatives, Vinove navigates the complexities of digital transformation in banking, delivering tangible benefits and empowering clients to embrace the benefits of digital banking solutions effectively.

Tips for Implementing Digital Solutions

Implementing digital solutions successfully requires meticulous planning and execution to achieve the benefits of digital transformation. Here are some tips to consider:

- Define Clear Objectives: Clearly outline the goals and objectives you want to achieve with digital transformation, is it improving customer experience or increasing operational efficiency?

- Engage Stakeholders: Involve key stakeholders, including employees, customers, and partners, from the outset to ensure their buy-in and support throughout the process.

- Choose the Right Partner: Select a trusted partner like Vinove Banking Services with expertise in digital transformation to effectively guide you through the implementation journey.

- Prioritize User Experience: Focus on designing intuitive and user-friendly interfaces to improve the overall customer experience and drive adoption of digital solutions.

- Ensure Security Measures: Implement robust security measures to safeguard sensitive data and protect against cyber threats in line with current digital banking trends.

By following these tips and leveraging the expertise of partners like Vinove, businesses can successfully navigate the complexities of digital transformation and unlock the full potential of digital banking solutions.

Future Trends and Innovations

Looking ahead, the future of digital transformation in the financial sector holds exciting trends and innovations that will shape the industry. Here’s a glimpse into what we can expect:

- AI-Powered Insights: AI technology will continue to grow, providing deeper insights into customer behavior and preferences allowing more personalized banking experiences.

- Blockchain Integration: The adoption of blockchain technology will increase, offering better security, transparency, and efficiency in financial transactions.

- Mobile-First Approach: With the proliferation of smartphones, mobile banking will become even more prevalent, driving banks to prioritize mobile-first strategies to cater to the needs of digital-savvy customers.

- Fintech Collaboration: Collaboration between traditional banks and fintech companies will accelerate, fostering innovation and driving the development of new financial products and services.

- Enhanced Cybersecurity Measures: As cyber threats emerge, there will be a greater focus on implementing advanced cybersecurity measures to protect customer data and financial assets.

Vinove Financial Technology is at the forefront of these future trends, leveraging its expertise in digital banking strategies and financial sector digitalization to help clients navigate the changing landscape effectively.

By adopting these innovations, businesses can stay competitive and deliver exceptional value to their customers in the digital age.

How is Vinove Different?

Vinove stands out in banking solutions and technology with its out-of-the-box approach and capabilities. Here’s why Vinove is different:

- Personalized Solutions: Vinove understands that every bank has unique needs and offers customized solutions for each client’s specific requirements and goals.

- Innovative Technology: Vinove stays ahead of digital transformation trends, utilizing cutting-edge technology to create innovative solutions that drive efficiency and growth in the financial sector.

- Robust Expertise: With years of experience in digital solutions for finance, Vinove brings deep expertise and industry insights to the table, ensuring clients receive the best-in-class services and support.

- Client-Centric Approach: Vinove prioritizes client satisfaction, going above and beyond to deliver exceptional value and exceed expectations at every journey step.

- Continuous Improvement: Vinove is committed to continuous improvement and adaptation, staying agile in response to evolving market dynamics and emerging digital transformation trends.

Vinove sets itself apart through its commitment to excellence, innovation, and client-centricity, making it a trusted partner for banks looking to thrive in an increasingly digital world.

In Closing

Vinove stands out as a leader in digital banking solutions and technology, driving the digital transformation on Vinove.

With our cutting-edge banking technology, we offer tailored Vinove banking solutions to meet the unique needs of banks in today’s digital age.

Our focus remains on providing the best-in-class digital banking solutions that streamline operations and uplift customer experiences.

Looking forward, we are committed to further advancing Vinove banking technology to empower banks in their digital transformation and ensure they stay at the forefront of the digital banking revolution.